MoIn today’s interconnected world, global financial institutions play a pivotal role in shaping economies, fostering international trade, and driving investment strategies. Exploring these institutions unveils a landscape rich in opportunities, innovation, and economic growth. From multinational banks to international development organizations, the world of finance offers a spectrum of institutions that collectively drive the global economy forward. This article serves as your guide to understanding, navigating, and benefiting from these influential players in the financial realm.

Exploring Global Financial Institutions

Global financial institutions are diverse entities that encompass a range of organizations, each with its unique purpose, structure, and impact. As you delve into this fascinating domain, you’ll encounter renowned names such as the International Monetary Fund (IMF), World Bank, and multinational banks like JPMorgan Chase and HSBC.

International Monetary Fund (IMF): Fostering Macroeconomic Stability

The IMF, established in 1944, stands as a cornerstone of international monetary cooperation. With a primary focus on ensuring global financial stability, the IMF provides economic analysis, policy advice, and financial assistance to member countries facing balance of payments problems. Through its expertise and financial support, the IMF plays a crucial role in stabilizing economies during times of crisis.

World Bank: Empowering Sustainable Development

:max_bytes(150000):strip_icc()/World_Bank_Final-b5b50f35c84e44ce8f0ffc30555627e9.jpg)

At the heart of international development lies the World Bank, a vital institution that provides financial and technical assistance to developing countries. By funding projects that promote infrastructure, education, healthcare, and more, the World Bank contributes to poverty reduction and sustainable economic growth, fostering a brighter future for communities worldwide.

Multinational Banks: Driving Global Commerce

)

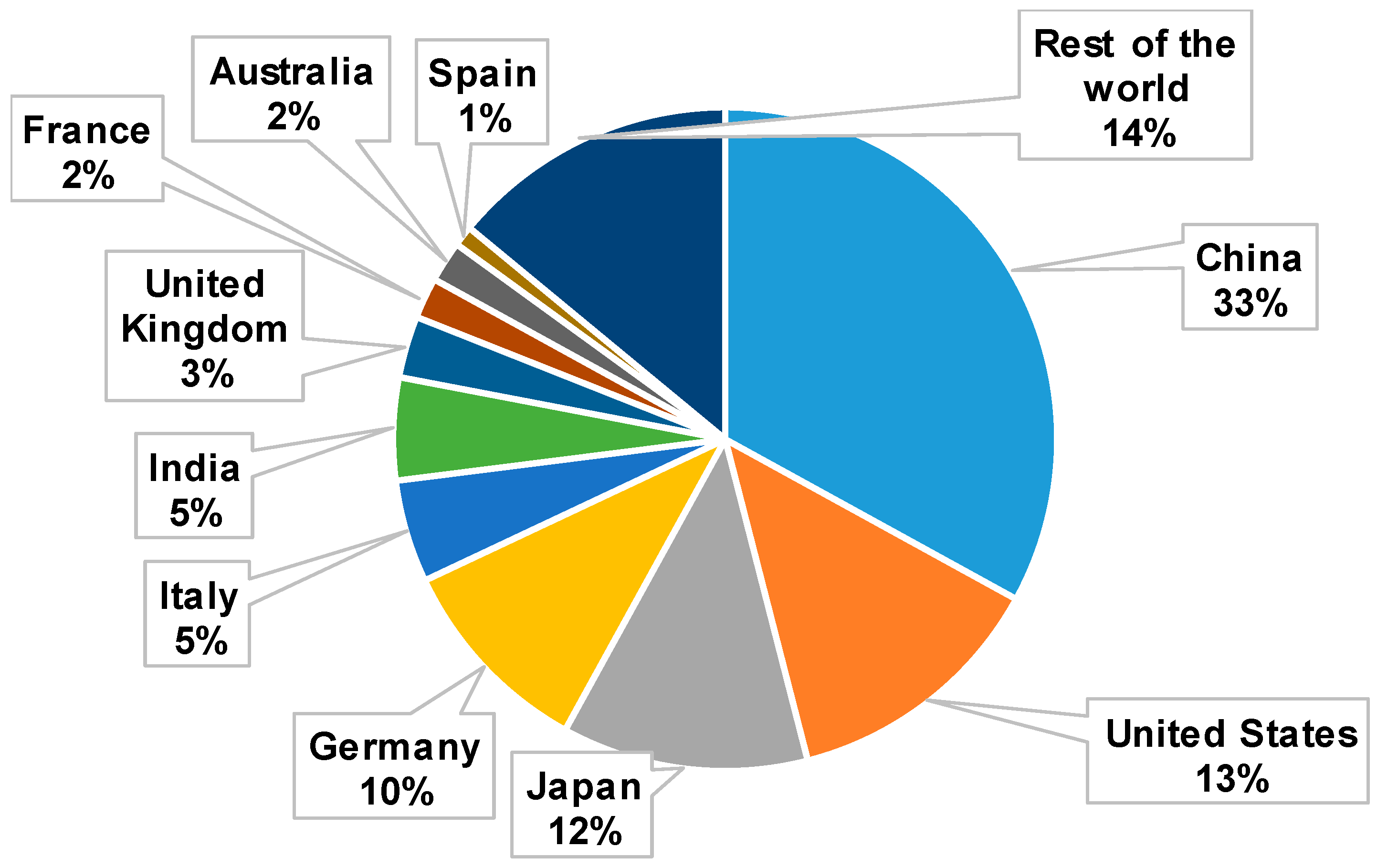

Multinational banks, such as JPMorgan Chase and HSBC, operate across borders, serving as catalysts for global trade and investment. These institutions offer an array of services, including corporate banking, investment banking, asset management, and retail banking. Their expansive reach and financial expertise facilitate cross-border transactions, enabling businesses and individuals to navigate the complexities of international finance.

Investment and Commercial Banks: Fueling Entrepreneurship

Investment and commercial banks are integral to fueling entrepreneurship and economic expansion. Institutions like Goldman Sachs and Citibank provide vital funding, advisory services, and capital market expertise to businesses of all sizes. By facilitating capital flows, these banks empower startups, SMEs, and corporations to innovate, expand, and contribute to economic prosperity.

Sovereign Wealth Funds: Harnessing National Wealth

Sovereign wealth funds (SWFs) manage a nation’s reserves and invest in diverse assets to achieve long-term financial goals. These funds, often funded by revenue from commodities or trade surpluses, contribute to economic stability and future generations’ well-being. SWFs like Norway’s Government Pension Fund Global exemplify prudent and strategic wealth management practices.

Opportunities Abound: Navigating the Path

Exploring global financial institutions unlocks a realm of opportunities for individuals, businesses, and governments. Whether you’re an investor seeking diverse portfolios or a nation aiming for economic resilience, these institutions offer avenues to achieve your goals.

Diversified Investments: Maximizing Portfolios

Global financial institutions provide access to a wide range of investment options. From stocks and bonds to alternative assets like real estate and commodities, these institutions enable investors to diversify their portfolios and manage risk effectively. By leveraging their expertise, investors can navigate complex financial markets and capitalize on global economic trends.

Funding and Capital: Empowering Business Growth

For businesses, access to funding and capital is essential for growth and expansion. Global financial institutions offer a plethora of financing solutions, from traditional loans to venture capital and private equity investments. Entrepreneurs can tap into these resources to launch startups, scale operations, and drive innovation across industries.

Economic Stability: Partnering with Governments

Governments collaborate with global financial institutions to achieve macroeconomic stability and sustainable development. Through policy advice, technical expertise, and financial support, these partnerships address challenges such as inflation, fiscal deficits, and trade imbalances. By aligning with these institutions, nations can foster resilient economies that benefit citizens and attract foreign investment.

FAQs

:max_bytes(150000):strip_icc()/how-swift-system-works.asp-Final-b308a4e3bf8b439f9ab467bd298262ef.png)

How do global financial institutions contribute to economic growth?

Global financial institutions play a pivotal role in driving economic growth by providing funding, expertise, and stability. They support businesses, governments, and individuals, fostering innovation, trade, and investment.

Can individuals invest directly in sovereign wealth funds?

Sovereign wealth funds are typically managed by governments and focus on national wealth management. However, some countries offer investment opportunities for citizens through specific programs or financial products.

What is the significance of multinational banks in international trade?

:max_bytes(150000):strip_icc()/Tradefinance_final_rev_02-e456c914d9eb47a9ac069c396dd0f09b.png)

Multinational banks facilitate international trade by offering trade finance, currency exchange, and cross-border payment services. Their global presence and financial infrastructure simplify transactions and reduce trade-related risks.

How does the World Bank promote sustainability?

The World Bank promotes sustainability by funding projects that address environmental, social, and economic challenges. These projects range from renewable energy initiatives to healthcare and education programs in developing countries.

How can businesses navigate complex international financial markets?

:max_bytes(150000):strip_icc()/what-financial-services-sector.asp-FINAL-fae9ce42c1824d9ca45343a6a3158c90.png)

Businesses can navigate international financial markets by partnering with investment and commercial banks. These institutions offer advisory services, capital market expertise, and financing solutions tailored to specific business needs.

What role does the IMF play during global financial crises?

During global financial crises, the IMF provides financial assistance, policy advice, and technical expertise to member countries. Its interventions help stabilize economies, restore confidence, and prevent further economic downturns.

Summary

Embarking on a journey to explore global financial institutions opens a world of possibilities. From the International Monetary Fund’s commitment to stability to the World Bank’s dedication to sustainable development, these institutions shape the economic landscape and empower individuals, businesses, and nations. As you navigate this intricate realm, remember that global financial institutions offer not only financial support but also invaluable insights and expertise that drive progress on a global scale.

More About Exploring global financial institutions